Latest News

- 32 minutes ago

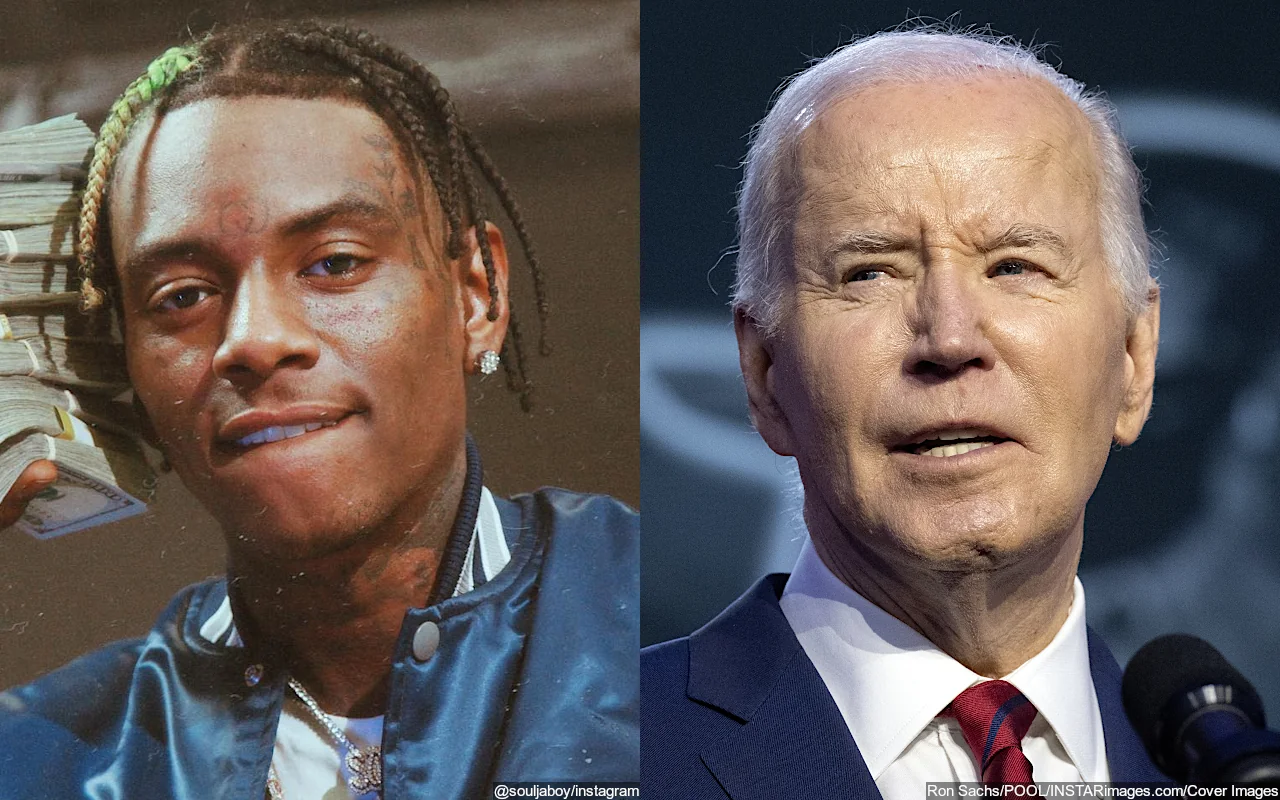

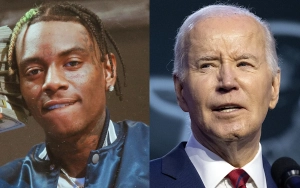

Soulja Boy Warns 'It's Not Funny' After President Biden Signs Law That Could Ban TikTok

Getting stressed out after Joe Biden signed into law a national security bill that would force TikTok to be sold by its owner, the 'Soulja Girl' rhymer says he's willing to buy the company.

- 33 minutes ago

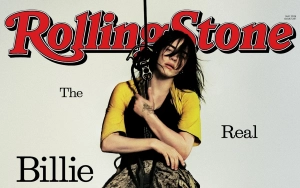

Billie Eilish's 'Skinny' From New Album Revealed as 'Sister Song' to 'What Was I Made For?'

Less than one month before 'Hit Me Hard and Soft' is launched, it is revealed that one of her songs from the album is 'even more devastating' than the 'Barbie' song.

- 47 minutes ago

Meghan Markle Sparks Chatter With Her Apparent Bigger Engagement Ring

Fans notice that the Duchess of Sussex's stunning diamond engagement ring is seemingly upgraded in a new Instagram photo for her friend Kelly Zajfen’s charity, Alliance of Moms.

- 47 minutes ago

Madonna Gushes About Sharing Stage With Children During 'Celebration Tour'

The 'Material Girl' hitmaker brings her children to the stage as 'The Celebration Tour' showcases her artistic contributions and the importance of family in her life.

- 1 hour ago

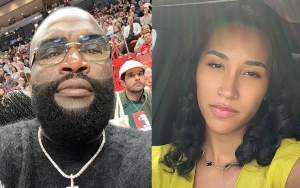

Rick Ross Moves on With Paige Imani After Cristina Mackey 'Clean' Breakup

The 'Aston Martin Music' rapper's new boo has been parading their romance on social media, a month after Cristina confirmed the end of her relationship with the Maybach Music Group owner.

- 1 hour ago

Gucci Mane Mocks Diddy in New 'TakeDat' Music Video After Diss Track Release

Shortly after launching a diss track against Diddy, the 'Blood All on It' rapper releases the 'TakeDat' visuals, in which he recreates the 'Satisfy You' spitter's iconic scene.

- 1 hour ago

Amanda Seales Denies Rumored Tense Relationship with Issa Rae

During her interview on 'Club Shay Shay', Amanda reveals details about her alleged strained relationship with her former co-star, who also produced the hit series.

- 2 hours ago

Courteney Cox Feels Blindsided When Fiance Johnny McDaid Broke Up With Her Mid-Therapy Session

During her appearance on the 'Minnie Questions' podcast, the former star of 'Friends' said he once broke up with her just one minute into their therapy session.

- 2 hours ago

Danny Boyle's '28 Years Later' Assembles Star-Studded Cast With Aaron Taylor-Johnson, Jodie Comer

The long-awaited sequel trilogy to Danny Boyle's 2002 hit zombie film '28 Days Later' is gaining momentum with the addition of A-list stars Aaron Taylor-Johnson, Jodie Comer and Ralph Fiennes to the cast.

- 2 hours ago

'1,000-Lb. Sisters' Star Tammy Slaton Impresses Fans With Swimsuit Pic

The TLC personality, who previously underwent bariatric surgery, shows off her slimmer look in a new picture shared on her Instagram account which features her posing by the pool.

- 2 hours ago

Machine Gun Kelly Celebrates 34th Birthday With Ex-Fiancee Megan Fox

The famous musician sparks speculation about his relationship status with her former fiancee, who joins him to celebrate his 34th birthday at a star-studded party.

- 3 hours ago

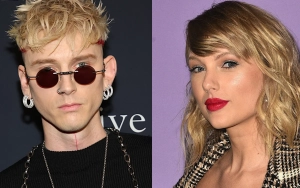

Machine Gun Kelly Defends Taylor Swift Against Diss Attempt, Cites Respect for 'Saintly' Singer

The 'Bloody Valentine' singer showers the 'Fortnight' singer with praise and tactfully avoids any confrontation with her formidable fanbase, the Swifties, when asked to criticize her during a spicy challenge.

- 3 hours ago

Madison Beer Transforms Into Killer Cheerleader in Sultry 'Make You Mine' Music Video

The 'All Day and Night' songstress releases the 'Make You Mine' official music video, in which she channels the spirit of Jennifer Check in a sultry and deadly performance.

- 3 hours ago

Usher Reveals Son's Sneaky Way to Get In Touch With PinkPantheress

The 'You Make Me Wanna...' hitmaker is left apologetic but appreciates his son Naviyd's creativity after the teen stole his phone so he could DM his favorite artist.

- 3 hours ago

Taylor Swift May Discuss Travis Kelce-Inspired 'Tortured Poets Department' Songs With Mom Donna

The 'All Too Well' hitmaker may receive a question from Donna about songs in 'The Tortured Poets Department' that are inspired by the Kansas City Chiefs tight end.

- 4 hours ago

Sacha Baron Cohen Vindicated as Publisher Redacts Rebel Wilson's Defamatory Claims in Memoir

After allegations of inappropriate behavior against the 'Borat' actor in the 'Pitch Perfect' star's bombshell memoir, the publisher has redacted the offending chapter.

- 4 hours ago

'Masked Singer' Recap: Group B and Wild Card Singers Perform on 'Girl Group Night'

Kicking off the show, panelists Ken Jeong, Robin Thicke, Jenny McCarthy and Rita Ora take the stage to do a group performance of Spice Girls anthem, 'Wannabe'.

- 4 hours ago

'Call Her Daddy' Host Alex Cooper Ties the Knot With Matt Kaplan in Tropical Wedding

The 'Call Her Daddy' podcast host reveals that she and the 'To All the Boys I've Loved Before' film producer held their wedding ceremony at a resort in Mexico.

- 4 hours ago

Princess Beatrice's Ex-Boyfriend Paolo Liuzzo Found Dead of Drug Overdose in Miami Hotel

The art industry consultant, who dated the British royal when she was a teen, had struggled with drugs and racked up big gambling debts prior to his death at 41 years old.